s corp tax calculator nyc

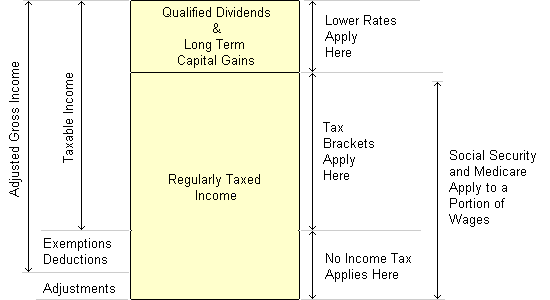

Like the states tax system NYCs local tax rates are progressive and based on income level and filing status. Calculate taxes for LLCs corporations electing Subchapter S tax treatment S-Corps and corporations not making Subchapter S elections C-Corps.

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

There are four tax brackets starting at 3078 on taxable income up to 12000 for single filers and married people filing separately.

. New York Estate Tax. If your company is taxed at a high level try our S Corp tax savings calculator. How s corporations help save money.

Not more than 100000. Annual state LLC S-Corp registration fees. Now if 50 of those 75 in expenses was related to meals and.

Dormant S corporations which did not engage in any business activity or hold title to real property located in New York City. If you are a qualifying manufacturer you will have a cap of 350000. Use this calculator to get started and uncover the tax savings youll receive as an S Corporation.

We are not the biggest firm but we will work with you hand-in-hand. There isnt a specific S corporation S Corp tax rate because S corp income isnt taxed at the business level. Enter the security code displayed below and then select Continue.

In new york city for example the general corporation tax is imposed on all corporations at a rate of 885. Estimated Local Business tax. As a sole proprietor you would pay self-employment tax on the full 90000 90000 x 153 13770.

Tax Bracket gross taxable income Tax Rate 0. If your business is incorporated in New York State or does business or participates in certain other activities in New York State you may have to file an annual New York State corporation tax return to pay a franchise tax under the New York State Tax Law. For example if you have a business that earns 200 in revenue and has 75 in expenses then your taxable income is 125.

More than 250000 but not over 500000. Forming an S-corporation can help save taxes. 10 -New York Corporate Income Tax Brackets.

This calculator helps you estimate your potential savings. More than 500000 but not over 1 million. Then well connect you with a CPA already successfully operating S Corporations in your state.

Start Using MyCorporations S Corporation Tax Savings Calculator. The instructions to Forms NYC-3L and NYC-4S explain in detail which types of S corporations are exempt from the general corporation tax including. The top rate for individual taxpayers is 3876 on income over 50000.

You can also use our New York property tax calculator to find out what you would pay in property taxes in New York. Reduce your federal self-employment tax by electing to be treated as an S-Corporation. Lets start significantly lowering your tax bill now.

If New York City Receipts are. Annual cost of administering a payroll. When taxing capital the rate is 015 with a cap payment of 1 million.

Fees for forming a corporation in New York. From the authors of Limited Liability Companies for Dummies. An S corp is better for businesses that have profit left over to pay owners a reasonable salary and at least 10000 in distributions.

Unlike a C Corporation an S Corp still enjoys the pass-through tax filing that partnerships pay. New York State Biennial Report Fee. For example in New York City an S-corp would be subject to the citys 885 business tax on top of state and federal taxes.

Common Fees for a New York Corporation. Smaller businesses with less net income will only have to pay 65. New York has a flat corporate income tax rate of 7100 of gross income.

Regardless if youre self-employed or an employee you have to pay Social Security and Medicare taxes to the government. New York Permits and Licenses. Instead S corp income in the form of salary and distributions passes through to the owners individual tax return.

This could potentially increase the S-corp tax bill significantly and essentially wipe out the other tax advantages offered by this entity structure. Fixed Dollar Minimum Tax is. New Yorks estate tax is based on a graduated rate scale with tax rates increasing from 5 to 16 as the value of the estate grows.

More than 5 million but not over 25 million. Shareholders pay New York tax on their pro rata share of the S corporation pass-through items of income gain loss and deduction that are includable in their federal adjusted gross income. Our S Corp Tax Rate guide explains how S corp taxes work and how to determine if an S corp is right for your business.

Learn about standard filing costs here for NY corporations. This application calculates the federal income tax of the founders and company the California state franchise tax and fees the self-employment tax for LLCs and S-Corps pass-through deductions for passthru entities and the. More than 100000 but not over 250000.

But as an S corporation you would only owe self-employment tax on the 60000 in salary 60000 x 153 9180 resulting in a savings of 4590. Nonresident shareholders and part-year resident shareholders pay tax only on the S corporation items derived from New York sources which is determined at the corporate level. Our small business tax calculator has a separate line item for meals and entertainment because the IRS only allows companies to deduct 50 of those expenses.

Enter your estimated annual business net income and the reasonable salary you will pay yourself as an S Corporation employee to begin. S corporations subject to tax under the banking corporation tax. A fee every other year when you file your biennial report.

Penalty and Interest Calculator. More than 1 million but not over 5 million. Information on this page relates to a tax year that began on or after January 1 2021 and before January 1 2022.

S Corp Tax Calculator Nyc. The exemption for the 2021 tax year is 593 million which means that any bequeathed estate. The following security code is necessary to prevent unauthorized use of this web site.

The federal corporate income tax by contrast has a marginal bracketed corporate income taxThere are a total of twenty three states with higher marginal corporate income tax rates then New York. The default LLC tax status is better for small businesses that reinvest profit to grow their business. Total first year cost of.

It will take into account any factors that can affect your savings. Another way that corporations can be taxed is directly on their business capital less certain liabilities. When you work for someone else youre only responsible for part of these taxes while your employer pays the balance you pay about 765 and your employer.

What Is Futa Tax 2021 Tax Rates And Information

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

New York Nys Tax Forms H R Block

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Christian Coronel Mercy College New York City Metropolitan Area Linkedin

What Are The Fees And Closing Costs When Buying A Coop In Nyc By Hauseit Medium

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Self Employment Tax Everything You Need To Know Smartasset

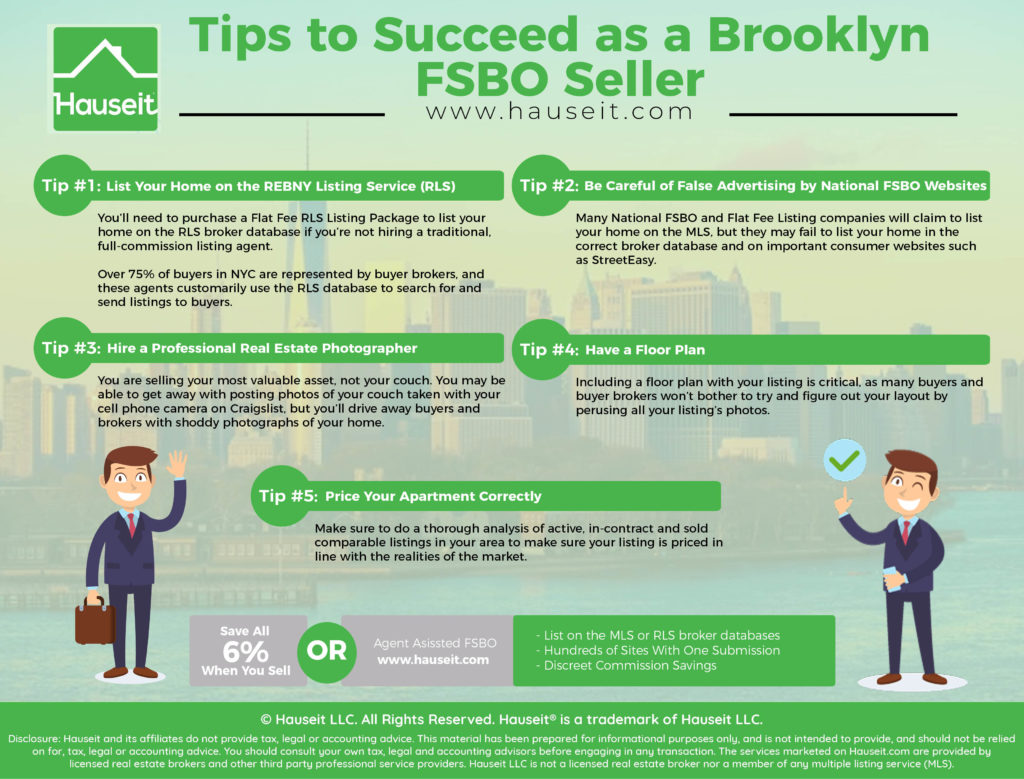

Tips To Succeed As A Brooklyn Fsbo Seller Hauseit Nyc

The Right Ratio Between Salary And Distribution To Save On Taxes

Capital Gains Definition 2021 Tax Rates And Examples

How Much Will I Have To Pay In Taxes As An Intern In New York City Quora

Nyc Ruling Levies Tax On Out Of State Corporation Small Businesses Benefit From Qsbs Exemption Qsbs Expert

Guernsey Low Income Households Protected From New Tax Bbc News

Florida Mortgage Calculator Smartasset

How To Calculate Additional Medicare Tax Properly

New York Nys Tax Forms H R Block

Nyc Ruling Levies Tax On Out Of State Corporation Small Businesses Benefit From Qsbs Exemption Qsbs Expert